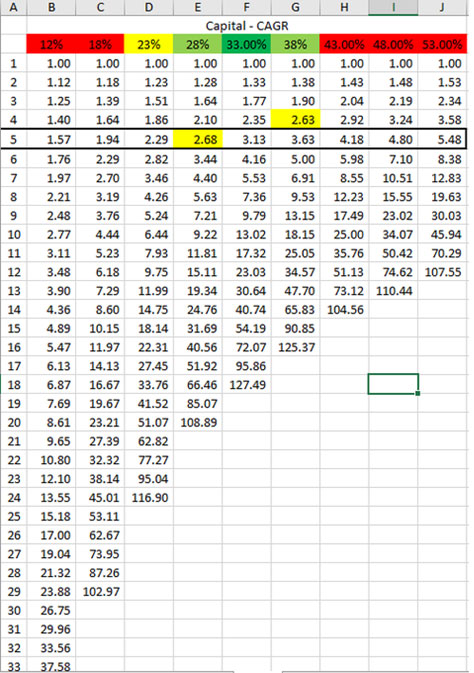

Imagine someone who wants to compound their wealth by 100x. The sweet spot lies with the CAGR component between 28% to 38%.

- Assume person-A who clocks 48% CAGR annually could make 100x in 13 years and person-B who clocks CAGR of 53% would do it in 12 years (1 year difference HARDLY matters in long run).

- However, Person-B might take HIGHER risk than person-A to achieve the said returns.

- Going by this logic, the sweet spot lies with the CAGR component of 28% to 38% where 100x might be possible within 16 to 20 years with minimal calculated RISK.

- For an options seller, collateral income from (Mutual Fund or index) could yield a CAGR of 12% to 15% Per annum coupled with 16% to 23% can be targeted from options selling with favorable RISK to REWARD strategies.

- Thus, yielding a cumulative compounded CAGR of 28% to 38%